How to easily purchase BTC and reap the rewards of the halving cycle on the Metaverse Exchange?

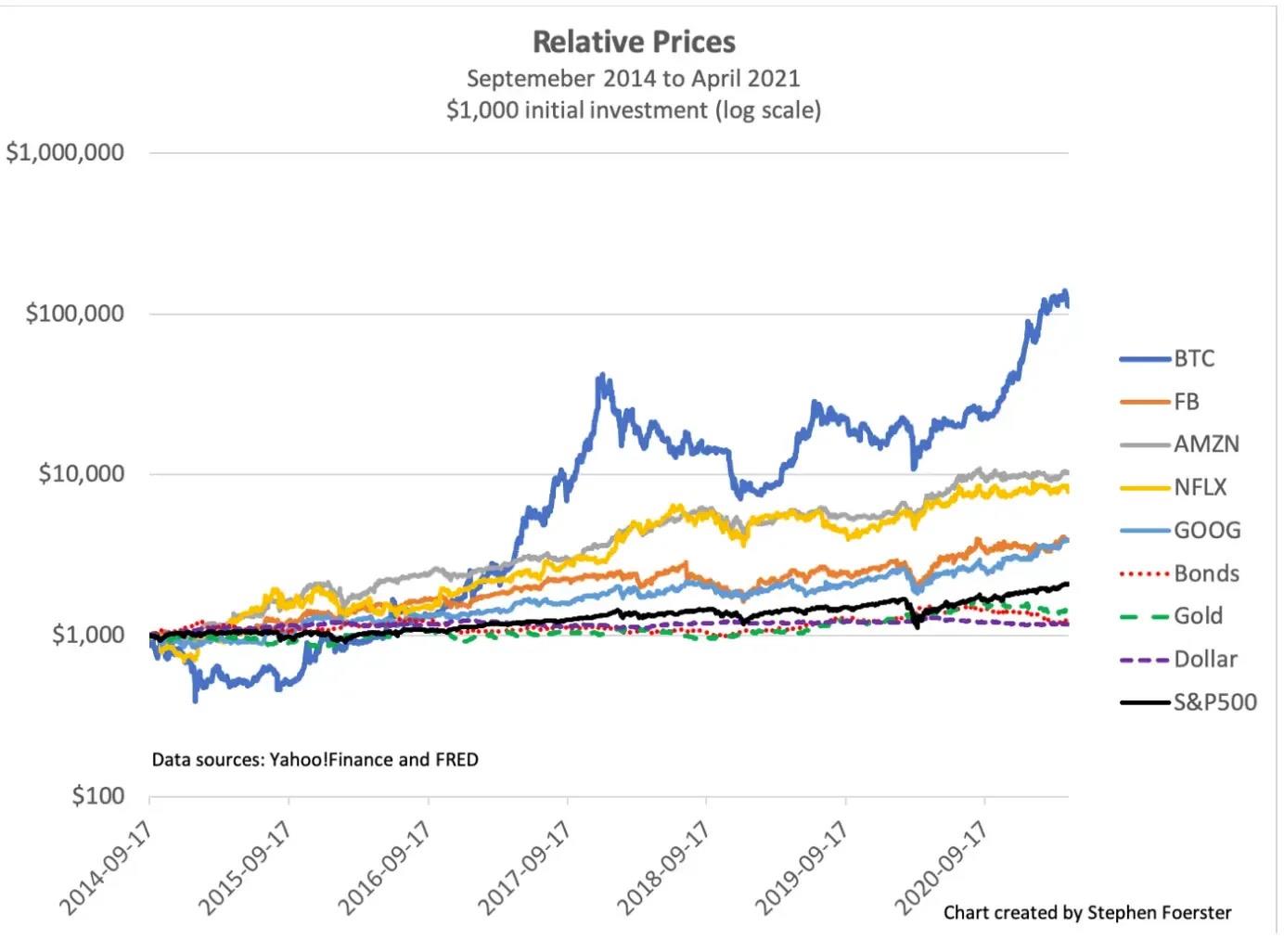

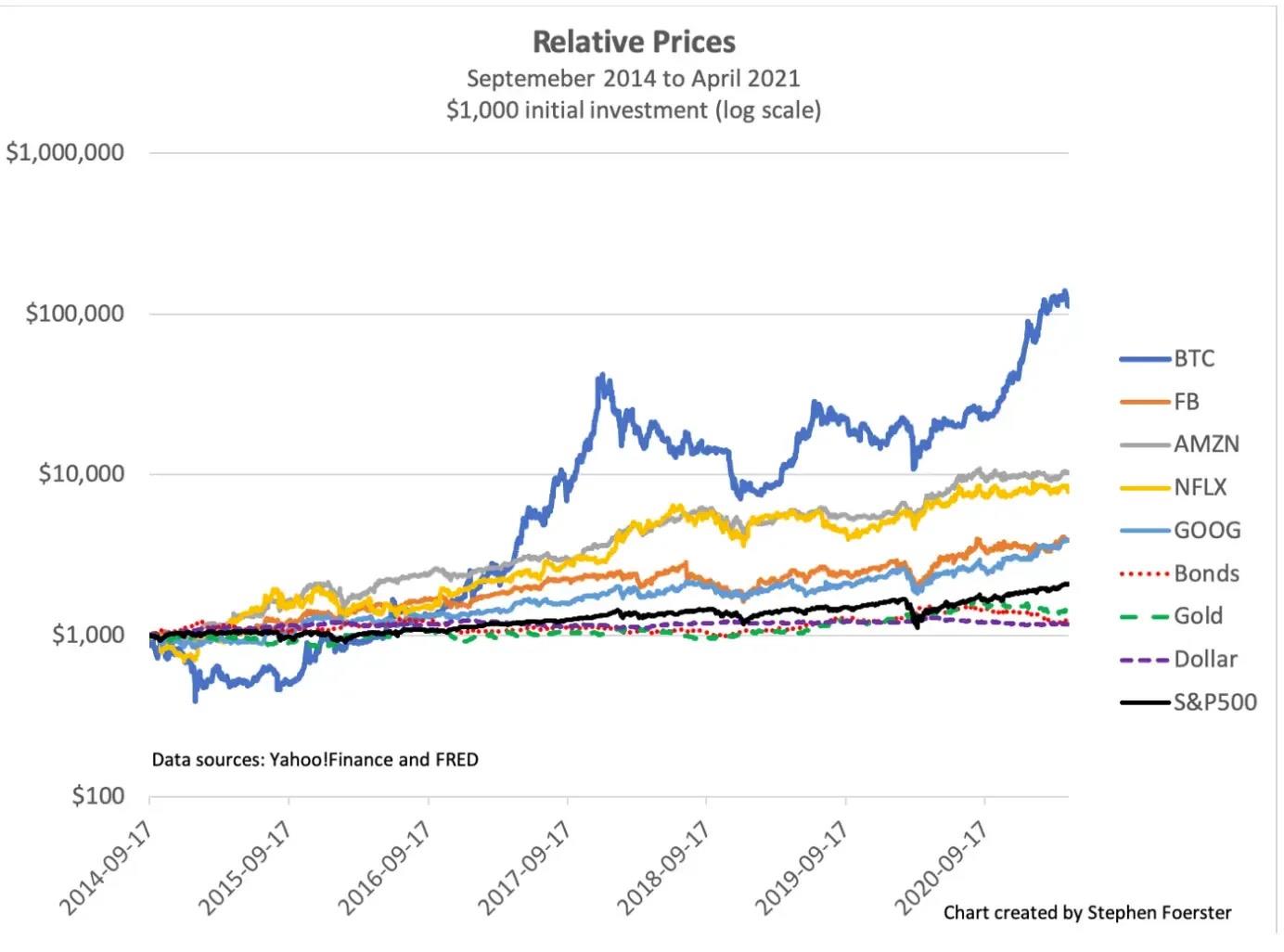

Gold is a proven asset that can maintain its value over the long term, and many investors use it to hedge against market downturns. However, in recent years, cryptocurrencies led by BTC have emerged as the best-performing investment products. An increasing number of investors are turning to crypto assets to hedge against economic recessions and adjustments. While Bitcoin and gold share some similarities, it is undeniable that Bitcoin has surpassed gold in terms of investment returns.

By:Chart created by Stephen Foerster

The recent cryptocurrency market has seen an increase in activity. With the continuous rise in prices of cryptocurrencies like BTC, investors in the crypto space have once again raised their expectations for the next bull market. The upcoming fourth halving of BTC has also become a topic of active discussion.

What is the Bitcoin halving cycle?

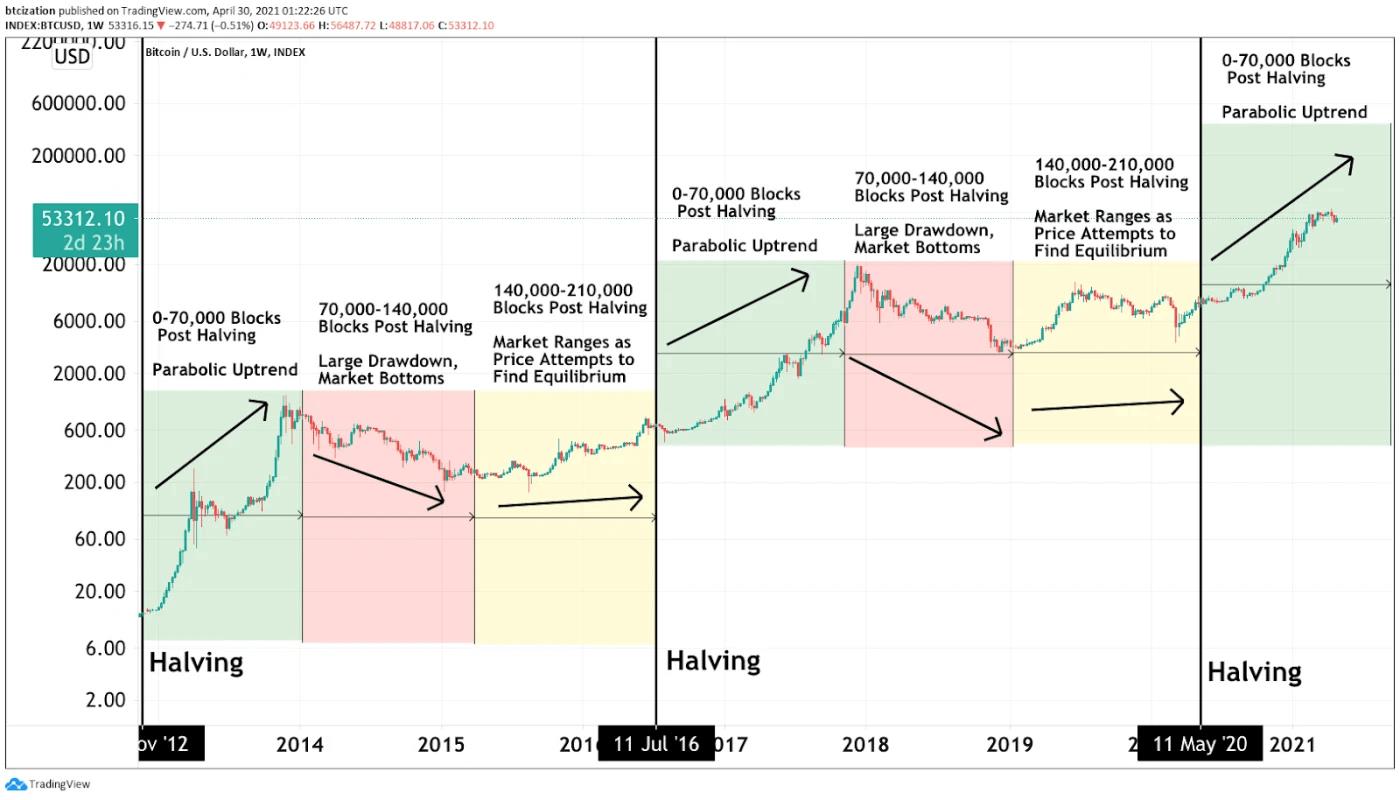

In the Bitcoin blockchain, those who validate transactions are rewarded with newly minted Bitcoins. After approximately every 210,000 transactions (roughly every four years), the number of newly minted Bitcoins is halved, hence the term "halving."

When Bitcoin was initially introduced, miners validating each block would receive a reward of 50 BTC. In 2012, the reward decreased to 25 BTC, in 2016 it became 12.5 BTC, and in 2020, it reduced to 6.25 BTC. The Bitcoin halving in 2024 will further reduce the reward per transaction block to 3.125 BTC. This halving cycle for Bitcoin will continue until the total supply reaches 21 million BTC by the year 2100.

By:Bitcoin Magazine

Based on the performance of previous Bitcoin halving cycles, in 2016, BTC was valued at $665 before the halving and reached $2,250 a year later. The halving in 2020 occurred in May, and by the end of that year, BTC's price soared to $29,000, marking the highest price of the year. Therefore, we can safely expect a bull market following each Bitcoin halving cycle. The reason for this is the decrease in supply due to the halving, resulting in a gradual reduction of newly minted Bitcoins entering the market. By simple supply-demand dynamics, we know that lower supply usually leads to price increases.

Opportunities for regular investors with Bitcoin halving

For both new and experienced users of cryptocurrency assets, it is typical for the crypto market to experience turbulence and bearish trends before the Bitcoin halving cycle. Based on simple trading logic, one can buy BTC at lower prices and hold onto it to enjoy the potential returns during the bull market phase. Compared to traditional investments, holding Bitcoin through the cycle often yields returns that are three times or even higher, which may seem crazy but is a reality for investors.

How to easily obtain Bitcoin on Metaverse Exchange?

For new cryptocurrency investors, buying Bitcoin typically involves learning how to convert fiat currency into USDT, which can be challenging on decentralized exchanges. Fortunately, Metaverse Exchange is very user-friendly for new users. On Metaverse Exchange, users can directly exchange fiat currencies from multiple countries and regions.

In addition, concerning any potential price differences in cryptocurrency trading pairs, Metaverse Exchange's self-developed matching engine analyzes real-time data from 100 cryptocurrency exchanges in the market. This ensures that every user's trades are executed at the best available prices, eliminating any real-time spread.

The most convenient way for new cryptocurrency investors to acquire BTC is through Metaverse Exchange, where they can complete the conversion and purchase of various cryptocurrencies using fiat currency. Moreover, these transactions are executed at real-time optimal market prices, which is highly advantageous for cryptocurrency investors. Even for experienced traders, using Metaverse Exchange can save time spent on comparing prices across different platforms. Purchasing BTC, ETH, and other cryptocurrencies on Metaverse Exchange has become easier.

Follow us:

Twitter:@MetaverseEX_BTC

交易商排行

更多- 监管中EXNESS10-15年 | 英国监管 | 塞浦路斯监管 | 南非监管93.02

- 监管中FXTM 富拓10-15年 |塞浦路斯监管 | 英国监管 | 毛里求斯监管88.21

- 监管中FXBTG10-15年 | 澳大利亚监管 |83.48

- 监管中GoldenGroup高地集团澳大利亚| 5-10年85.87

- 监管中IC Markets10-15年 | 澳大利亚监管 | 塞浦路斯监管91.71

- 监管中CPT Markets Limited5-10年 | 英国监管 | 伯利兹监管91.56

- 监管中AUS Global5-10年 | 塞浦路斯监管 | 澳大利亚监管86.47

- 监管中OneRoyal10-15年 | 澳大利亚监管 | 塞浦路斯监管 | 瓦努阿图监管85.75

- 监管中易信easyMarkets15-20年 |澳大利亚监管 | 塞浦路斯监管85.38

- 监管中FXCC10-15年 | 塞浦路斯监管 | 直通牌照(STP)85.26